Unlocking XRP Liquidity: Why Evernorth is Leaning In on the XRP Lending Protocol

By: Sagar Shah, Chief Business Officer, Evernorth

XRP has spent over a decade as a powerhouse for payments and cross-border settlement. But for years, one question has persisted for institutional holders and long-term believers: “How do we put our XRP to work?” Unlike Proof-of-Stake networks, XRP hasn’t traditionally offered a native way to generate yield on "idle" assets.

That could soon change.

Today, we are thrilled to announce Evernorth’s intent to utilize the upcoming XRP Lending Protocol (XLS-66) as a core pillar of our digital asset strategy. This isn't just another DeFi experiment; it's what we believe could be a fundamental shift in how institutional liquidity moves onchain. By participating in this native lending ecosystem, Evernorth aims to help unlock what could be a multi-billion dollar annual yield opportunity for the XRP community.

In this post, we’ll break down the business case for this move, why we chose a native protocol over "bridging," and how this new amendment may create a supply-and-demand flywheel that could influence XRP’s market dynamics.

The Native Revolution: Bringing Yield to the "Idle" Giant

XRP currently holds a market cap of approximately $100+ billion*, yet much of that capital sits in cold storage or centralized exchanges, waiting for the right utility to bring it onchain.

The Lending Protocol (XLS-66) is designed to act as the missing engine. It would allow holders like Evernorth to deposit XRP into Single-Asset Vaults (SAV). These vaults aren't your typical "black box" lending pools; they are native primitives that are designed to enable institutional-grade, fixed-term, and fixed-rate loans.

How it Works

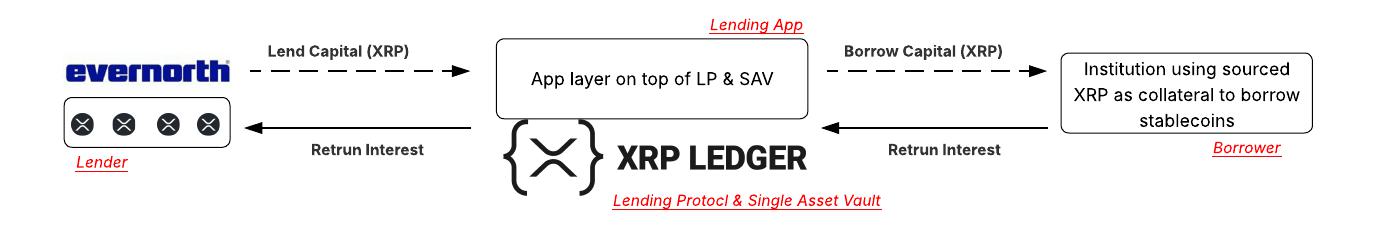

At its simplest, the protocol is designed to create a streamlined pipeline between those with capital and those who need it:

- Lenders: Deposit liquidity into a dedicated XRP vault.

- Institutional Borrowers: Draw XRP loans to power their business strategies, such as market making or collateral management, without having to liquidate their own positions.

- Expected Outcome: A scalable, secure yield product that keeps XRP onchain and productive.

If the protocol achieves its target benchmark yield and attracts broad participation, the ecosystem could generate billions in annual value that previously didn't exist.

* As of January 28, 2026, based on a circulating supply of ~60B units of XRP; market capitalization fluctuates and this figure is provided for illustrative purposes only.

Security and Tax Efficiency: The "Why Native" Decision

When institutions look at DeFi, they often face a dilemma: Do we bridge our assets to another chain to find yield? For Evernorth, the case for native yield is compelling, and here is why:

Bridging XRP to an external network typically triggers two major challenges:

- Tax Events: In many jurisdictions, the act of "wrapping" or "bridging" an asset can be viewed as a taxable disposal of the original asset. This creates immediate friction for large-scale institutional moves.

- Smart Contract Risk: Bridging requires trusting a third-party bridge or a new, unproven smart contract environment.

The Native Advantage

The XRP Lending Protocol is a native feature. It doesn't require "wrapping" your XRP or moving it to a separate ledger. It inherits 13 years of XRP operational history. For an institution like Evernorth, this means we could access yield while keeping our assets on a ledger with a proven track record.

Beyond Spreadsheets: Solving the Reconciliation Nightmare

A common question we hear is: "Why not just do a simple wallet-to-wallet loan?" On the surface, it seems easy. In practice, for a fintech or financial institution, it can be an operational headache.

Manual, off-chain lending between two wallets creates a Triple Database Problem:

- The Lender has their database tracking interest and terms.

- The Borrower has their database tracking repayments.

- Middlemen (like custodians or auditors) have a third set of records.

This fragmentation leads to "reconciliation error risk". If the price of XRP fluctuates between the time of deposit and the time of repayment, or if an interest calculation differs by a fraction of a percent, the parties can find themselves in drawn-out disputes.

The XRP Lending Protocol addresses this by providing a single, verifiable database of truth. The ledger itself is designed to automate the contract terms - repayment schedules, interest calculations, and even late payment penalties - at the protocol level. This reduces the potential for error, helping ensure that every participant is looking at the exact same numbers in real-time.

Market Implications: The Supply-Utility Flywheel

One of the broader benefits we see is moving XRP from "idle" (sitting on exchanges) to "productive" (deployed in protocol vaults). When capital is put to work rather than sitting dormant, it supports the overall health and utility of the ecosystem.

Conclusion: A Call to Governance

The business case is clear. For lenders like Evernorth, the XRPL Lending Protocol (and Single Asset Vault) offers what we believe is an attractive way to grow our treasury. For institutional borrowers, it provides the capital-efficient credit needed to scale brokerage businesses. And for the XRP ecosystem, it could create a flywheel of utility that drives onchain growth.

However, this future depends on the community. The Lending Protocol represents a potential step in the evolution of XRP into a mature, institutional-grade finance platform.

Our Call to Action: We invite the developer community and validators to join us in a phase of exhaustive technical 'stress testing' of the proposed amendment: run the simulations, verify the contract integrity, test the repayment logic, validate the vault mechanics, and provide your most critical feedback. Help us confirm that the feature implementation is as secure as the ledger itself.

Let’s put XRP to work, together.

Sagar oversees partnerships, product commercialization, and ecosystem strategy at Evernorth. Prior to Evernorth, Sagar helped grow the XRP ecosystem at Ripple where he scaled Ripple’s blockchain based cross-border payments solution, led the acquisition of digital asset custody platform Metaco, and drove the launch of Ripple’s U.S. dollar stablecoin, Ripple USD (“RLUSD”)

Evernorth is a publicly listed digital asset treasury (Nasdaq: XRPN) dedicated to institutional-scale XRP adoption and DeFi yield opportunities. Led by CEO Asheesh Birla and a team of fintech veterans, Evernorth is building the infrastructure for tomorrow’s tokenized economy.

Important Disclosures

This blog post contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based on current expectations and are subject to risks and uncertainties that could cause actual results to differ materially. The XRP Lending Protocol (XLS-66) is a proposed amendment that has not yet been approved or implemented. There is no guarantee the protocol will be approved, function as described, or achieve the yields discussed. Participation in digital asset lending involves substantial risk, including the potential loss of principal.

This post is for informational purposes only and does not constitute investment, tax, legal, or financial advice. Tax treatment of digital asset transactions varies by jurisdiction, consult your own tax advisor.

For complete risk factors and forward-looking statement disclaimers, please see: